10 Ways to Get Rich with Cryptocurrency in 2024

Cryptocurrency has really revolutionized finance by allowing so many different ways one can gain wealth. Starting from staking and trading to yield farming and even NFTs, crypto enthusiasts have a few options for growing an income. This article shall walk you through 10 ways you can get rich with cryptocurrency in 2024. With the full knowledge of the potential that each of these methods possesses, you will be able to choose for yourself the best strategy to make your goals happen.

-

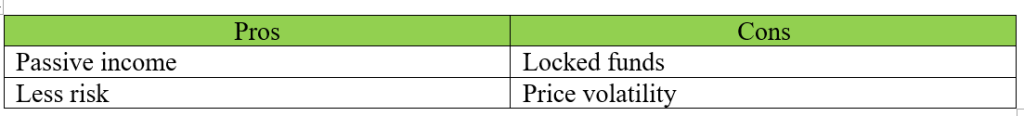

Staking in Crypto

Staking has turned into one of the most popular ways of creating passive income within the crypto world. It involves locking your cryptocurrency in the blockchain network for use in verifying the transactions that are to be adopted into it, ensuring the network is functional and safe. In return, you will receive staking rewards dependent on the used network and the amount of crypto that you stake. Staking is particularly attractive to long-term holders who wish to minimize active trading. This offers a more stable, predictable return compared to other methods of investing in crypto.

StakingBonus.com

This is a one-stop platform that assists in connecting users with bonus rewards from various blockchain stakings. The website includes details on all the best staking plans, their potential returns, and how to exploit them. Be it Cardano ADA, Polkadot DOT, Ethereum ETH, or every other known cryptocurrency staking, StakingBonus presents you with the knowledge you need to make a decision.

Registration Process

To start using StakingBonus, follow these few easy steps:

Create an account on StakingBonus by filling in the basic details.

Look for the list of staking plans available and compare yields to see which is the best for you.

Follow specific staking instructions for a certain cryptocurrency network.

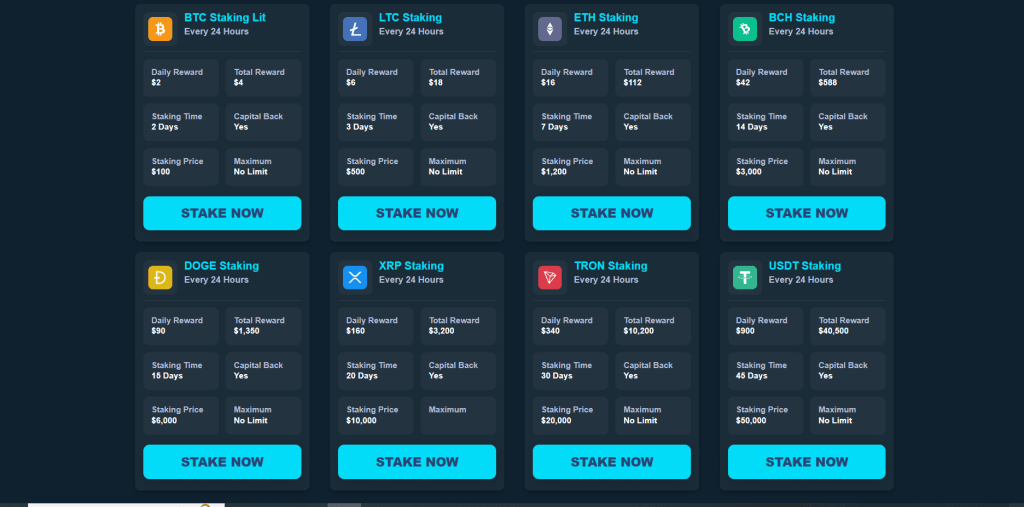

Staking plans available

Bitcoin (BTC): Usually a Proof-of-Work asset, BTC staking options on StakingBonus represent an alternative for those investors who seek more stable, long-term growth.

Litecoin (LTC): Given that it is among the fastest and cheapest alternatives to BTC, staking LTC on StakingBonus means consistent returns but at much lower fees.

Ethereum (ETH): ETH staking probably is the most popular form of passive rewards on the blockchain after Ethereum moved to a Proof-of-Stake consensus algorithm.

Bitcoin Cash (BCH): This type of investment is perfect for investors who look to take advantage of BCH’s scalability and relatively lower transaction fees against Bitcoin.

Dogecoin (DOGE): As a fun, community-driven cryptocurrency, DOGE is highly rewarding, especially for more extended periods, when staked through StakingBonus.

Ripples: This ensures comfortable returns for XRP, a coin known and utilized for fast and inexpensive cross-border transactions.

TRON (TRX): TRON focuses on decentralized content creation; hence, this coin will be an exciting option to stake for those interested in taking part.

Tether (USDT): Stablecoin is pegged against the US dollar, which makes staking USDT a low-risk and stable return investment without going through the volatility that other cryptocurrencies are prone to.

-

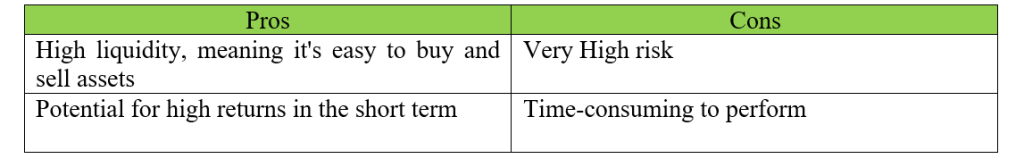

Crypto Trading

Crypto trading entails the buying and selling of virtual assets with the hope of making a profit based on changes in price. It is usually much more active, hands-on compared to staking, and traders need to follow the markets all the time, analyze the trends that are forming, and make quick decisions. While it is pretty risky, it can therefore give quite significant returns if done right.

-

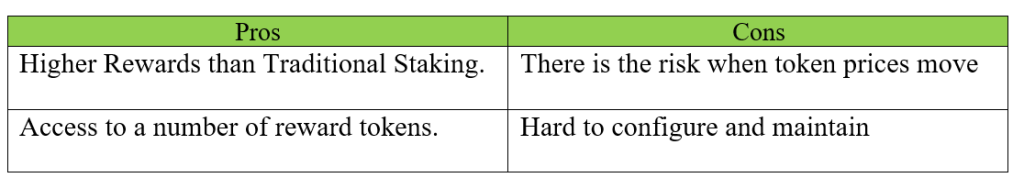

Yield Farming

Yield farming is one of the methods to earn interest through lending or staking crypto in decentralized finance platforms. Hereby, users provide liquidity to some pools and, correspondingly, get rewards that can be very high compared with traditional investments. However, with yield farming, the risks are higher: one may suffer an impermanent loss or take hits because of changes in market conditions.

-

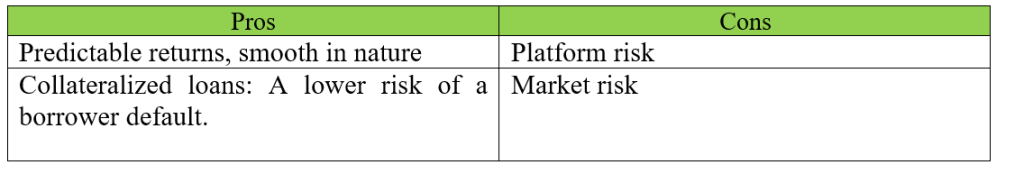

Crypto Lending

Crypto lending websites allow users to lend their digital assets to other borrowers while earning interest off it. The borrower typically provides security collateral in return, which lowers the risk for the lender. Lending is perfect for those users who want to have consistent, predictable returns without actively participating in trading or any other high-risk activity.

-

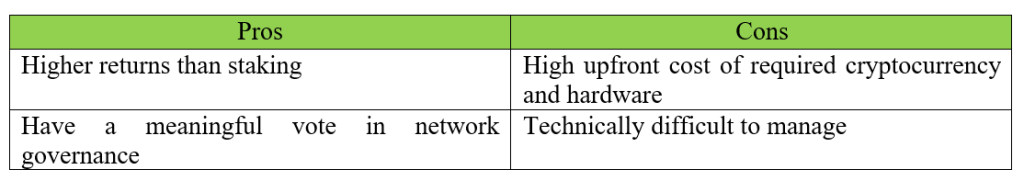

Masternodes

Running a masternode allows users to contribute to the security of specific blockchain networks and get rewards. Master nodes are resource-intensive, with many requiring a high upfront investment in hardware and cryptocurrency. They tend to pay higher rewards as well.

-

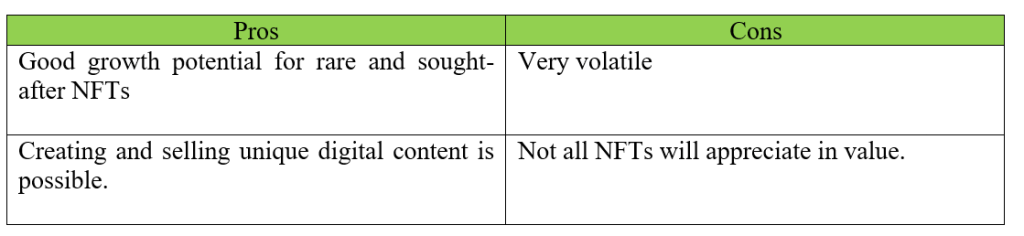

NFTs: Earn from Digital Collectibles

Non-fungible tokens are unique digital collectibles, digital art, music, or even in-game items. As one may have guessed, they are very popular because ownership of specific NFTs can appreciate over time-particularly those that are truly one-of-a-kind or highly sought after. Investing in these NFTs will yield a significant profit if the market demand continuously supports them.

-

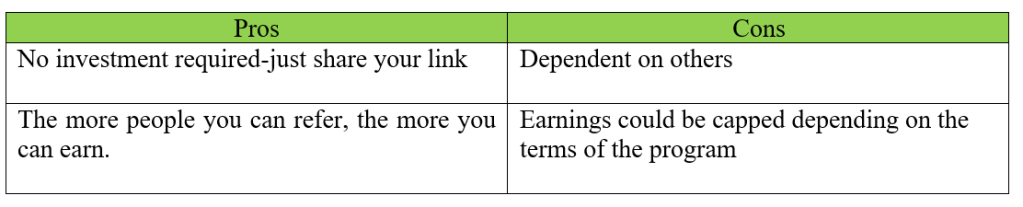

Referral Programs

Most crypto platforms maintain programs for referrals whereby their users can be rewarded for inviting others to join their sites. These are designed to reward both the referrer and the new user so that the process is rather easy and passive.

-

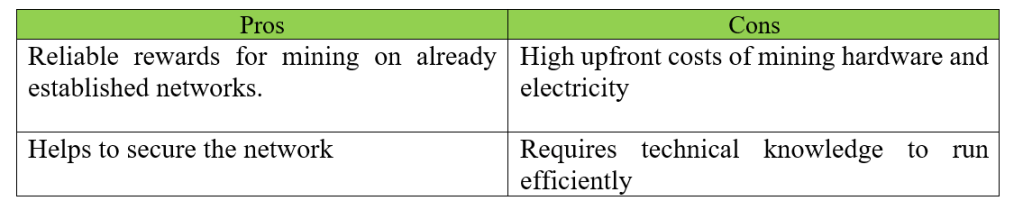

Mining

Crypto mining refers to the process in which a miner uses computer power to solve complex mathematical problems validating transactions across the blockchain network. As a way of rewarding the miners for this work, they are given newly minted tokens. Nowadays, the mining of some cryptocurrencies-like Bitcoin-already pays off, but this largely requires huge investments in hardware and electricity.

-

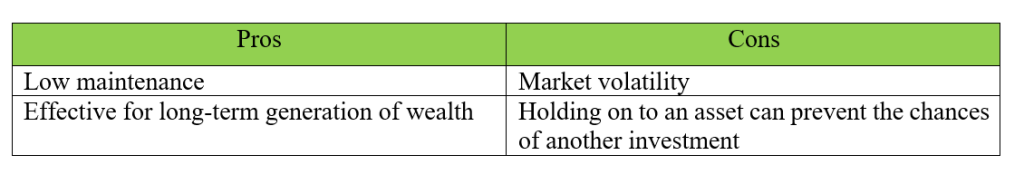

HODLing

The strategy of HODL originally means a misspelling of the word “hold,” and it’s all about buying and holding up cryptocurrency over an extended period many times on the assumption that it would surge in value over time. This strategy particularly works well in the case of an established cryptocurrency like Bitcoin, Ethereum, or Cardano, which have shown exponential growth patterns.

-

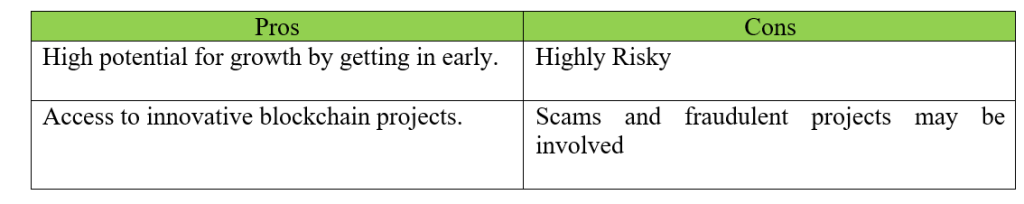

Initial Coin Offerings and Token Sales

Sometimes, participation in an ICO, or token sale, affords access to new cryptocurrencies before they come into large exchanges. Whether this project starts attracting attention, then the value of such a token may increase significantly, hence yielding fantastic returns for early investors.

Conclusion

For 2024, manifold ways of building wealth in the world of cryptocurrency exist, including but not limited to staking, trading, farming yields, and NFTs. From staking to how StakingBonus helps an investor navigate the complications with staking and other facilities, there are different ways one can pull through. All you have to do is know the pros and cons of each and use that knowledge to develop a diversified strategy that you can use to capitalize on the immense opportunities existing within the crypto space.

FAQs

- What personal data do you need to provide to the company?

The main personal information we need is your email, payment details and username.

- Who can become an investor of the company?

Any competent person who has reached the age of majority according to the laws of his country (or in any case, no less than 18 years old) can become an investor of StakingBonus.

- How do I open a staking?

It’s easier than ever – all you need to do is to register on our website, choose a suitable stake plan and replenish your account with a suitable amount.

- Which payment systems do you accept?

We work with such crypto payment systems as Bitcoin, Litecoin, Ethereum, BitcoinCash, Dogecoin, Ripple, Tether, Tron.

- What is the minimum amount of staking?

The minimum staking amount only starts from 100 USD.

- When will I receive an interest on my deposit?

Accruals on our clients’ staking occur every 24 hours, starting from the moment of staking creation, according to the conditions of a chosen investment plan. When creating a deposit, be sure to pay attention to the term of the deposit (number of days) and the payout schedule.

- How long will it take to withdraw my profit to my wallet?

Yes, All withdraw on our system is instant.

Disclaimer: This is a paid release. The statements, views and opinions expressed in this column are solely those of the content provider and do not necessarily represent those of NewsBTC. NewsBTC does not guarantee the accuracy or timeliness of information available in such content. Do your research and invest at your own risk.

Disclaimer: The information found on NewsBTC is for educational purposes

only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any

investments and naturally investing carries risks. You are advised to conduct your own

research before making any investment decisions. Use information provided on this website

entirely at your own risk.

Bitcoin On The Brink: Predictions Range From $56K To $180K As Analysts Eye Breakout

The price of Bitcoin has been a heated issue recently since different financial institutions project different future images of it….

Bitcoin Peaks At Highest Value In 2 Months Above $65,000: Bull Run Predictions

For the first time in nearly two months, Bitcoin (BTC) has surpassed the $65,000 mark, marking a significant recovery following…

Synesis Foundation and AirMoney DEGN Partner to Redefine AI and DePIN Hardware Innovation

In a move to reshape the decentralized landscape, Synesis Foundation, the developers behind Solana’s first AI data pre-processing solution, has…