Top 5 Best Staking Platforms for Maximum Rewards

Este artículo también está disponible en español.

Crypto staking has become one of the best ways investors can receive passive income while securing blockchain networks. Top 5 Crypto Staking Providers in 2024 Despite the design of staking-selecting the best option for rewarding mechanisms proves to be daunting. This article will rank the top crypto staking providers highlighting OkayCoin followed by Binance, Coinbase, Crypto.com, and Lido.

OkayCoin

OkayCoin is leading in providing the best staking opportunities, together with an easy-to-use interface and competitive rewards for staking. Diversification in the types of cryptocurrencies available to stake on this platform makes many different investors, from beginners to well-seasoned ones, take a closer look.

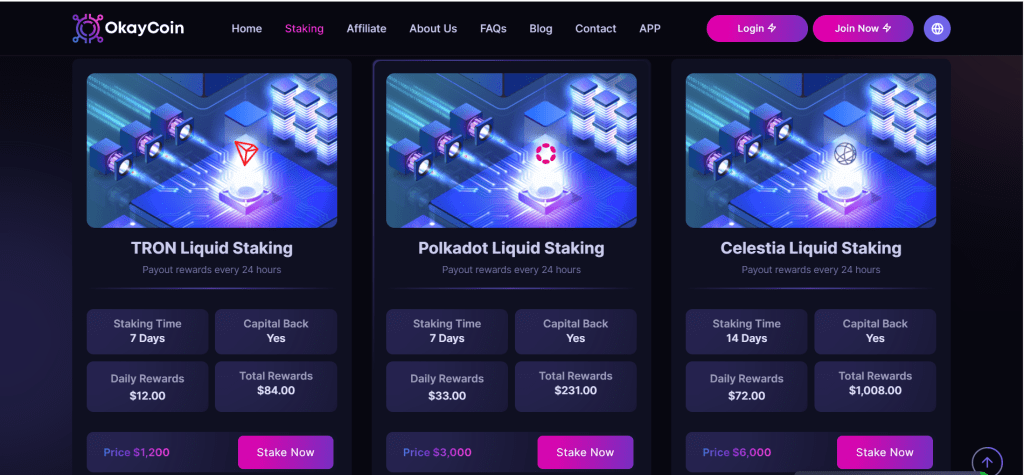

Staking Options on OkayCoin

Ethereum (ETH): Stake ETH and be a part of Ethereum’s migration to Proof of Stake with Ethereum 2.0 while earning rewards for securing the network.

Polygon (MATIC): OkayCoin allows staking of MATIC for competitive yields while contributing to Ethereum scaling via the Polygon network.

Tron (TRX): In return, an investor receives consistent rewards by staking TRX on OkayCoin while being involved in the governance of the Tron blockchain.

Polkadot: DOT staked on OkayCoin provides a high yield while contributing to the cross-chain capability of Polkadot.

Celestia: Being one of the newer blockchain projects, staking with Celestia on OkayCoin contributes to its modular architecture and brings good rewards.

Aptos: Staking APT allows any investor to generate yield while contributing to a blockchain known for scalability and performance.

SUI: The staking of Sui on OkayCoin is one of the best ways to earn passive income while supporting a blockchain focused on fast and secure transactions.

Avalanche: A platform with ultra-fast transaction processing and innovative subnets offers appealing returns at OkayCoin.

Cardano: Cardano is among the most popular Proof of Stake blockchains, and OkayCoin provides ADA stakers with stable rewards.

Solana: Stake SOL on the OkayCoin exchange for high-yield returns while contributing to one of the most scalable blockchain networks boasting high-speed, low-cost transactions.

Okcoin Staking Key Features

High Staking Rewards: Okcoin offers competitive rewards on multiple assets while offering flexible staking periods of several days to many months.

Low Fees: Investors can maximize their profit with minimum fees attached to staking.

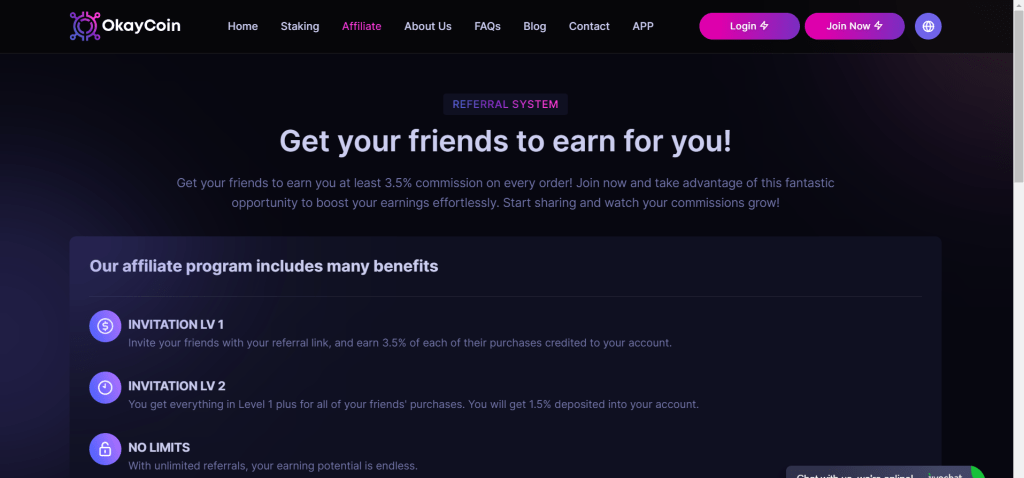

Referral Program

The referral program by OkayCoin gives every user the opportunity to increase rewards by inviting friends to the platform. Here you will get the chance to earn at least a 3.5% commission on every order. This is a fantastic opportunity to boost your earnings effortlessly.

How to Sign Up on OkayCoin

At the time you sign up, you will get a $100 welcome bonus which is a great opportunity.

Create an Account: At first, you are supposed to sign up through the OkayCoin website of OkayCoin by following the registration and Know Your Customer process.

Deposit Crypto: After setting up your account, deposit crypto or even buy from crypto exchange at OkayCoin.

Start Staking: Go to the staking section, choose your asset from the drop-down list, such as Ethereum or Polygon, and click Start Staking. From this point on, rewards will start accruing.

Binance

Binance boasts some of the widest varieties in staking options. While it offers staking for more than 100 assets, including some very popular ones such as Ethereum, Polkadot, and Solana, Binance has something to offer in terms of flexibility for all kinds of investors.

Key Features

Flexible and Locked Staking: Get flexible staking where you can withdraw at any time or opt for locked staking to receive higher yields.

Binance Launchpool: The Launchpool enables users to stake their assets for newly launched tokens.

High Liquidity: Binance has very high liquidity. In this respect, it is quite easy to enter and exit a staking position.

Coinbase

Coin-base is one of the most beginner-friendly platforms due to its friendliness to its users and the clarity of the staking options it offers. Though it doesn’t have as many assets as Binance or OkayCoin, Coinbase doesn’t stress over quantity; it would rather focus on quality.

Key Features

Staking of Popular Assets: The list includes Ethereum, Tezos, Algorand, etc.

Earn While You Learn: Coinbase’s educational programs bring users to learn about cryptocurrencies and at the same time, earn small portions of crypto.

Ease of Use: Coinbase isn’t overly complicated, and that sets it apart as one of the best options for a user who has never staked on a blockchain before.

Crypto.com

Crypto.com is another versatile staking service that hosts a wide variety of assets. Better known for its rewards-based ecosystem, Crypto.com provides a very distinctive staking experience and really feels a part of its wider ecosystem.

Key Features

Stake CRO to Extend Your Benefits: Staking Crypto.com’s native token, CRO, will extend benefits such as higher cashback rewards on the Crypto.com Visa Card.

Competitive Rewards: Crypto.com will offer strong yields on a number of leading assets such as Ethereum, Polkadot, and Cardano.

Flexible Terms: Options are flexible, one-month, or three-month staking terms to suit your risk appetite and liquidity needs.

Lido

Lido is one of a kind staking solution that enables users to realize the benefits of staking without compromising on liquidity. With liquid staking, Lido makes sure that people stake their crypto without necessarily tying up their money for a long time.

Key Features

Liquid Staking: Users receive staked tokens, such as ETH, that represent their staked assets and can be utilized in other DeFi activities. Lido is one of the top services offering Ethereum 2.0 staking, therefore helping users get their rewards for maintaining work on the Ethereum network.

Community Governance: The Lido governance is decentralized, hence allowing stakers to contribute to great decisions in terms of what happens with the platform going forward. Lido’s liquid staking proves ideal for investors who seek flexibility along with staking rewards; for those interested in locked-in rewards, OkayCoin remains a better option.

Conclusion

In 2024, staking emerged as one of the most essential tools for crypto investors to earn significant passive income in addition to making a contribution to blockchain networks. OkayCoin dominates in terms of maximum rewards, ease of staking, and the number of assets supported. But Binance, Coinbase, Crypto.com, and Lido are equally competitive services where investors can get numerous choices. Sign up on OkayCoin today and begin staking to earn rewards, and remember to use their referral program to benefit even more.

Disclaimer: This is a paid release. The statements, views and opinions expressed in this column are solely those of the content provider and do not necessarily represent those of NewsBTC. NewsBTC does not guarantee the accuracy or timeliness of information available in such content. Do your research and invest at your own risk.

Disclaimer: The information found on NewsBTC is for educational purposes

only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any

investments and naturally investing carries risks. You are advised to conduct your own

research before making any investment decisions. Use information provided on this website

entirely at your own risk.

NEIRO Meme Coin Minting Millionaires, Whales Accumulating: Is This The Start Of The Bull Run?

First Neiro on Ethereum (NEIRO), a meme coin, is one of the top performers this week. Over the last seven…

Ethereum In 2021 Vs. 2024: Fractal Suggests Major Breakout In Q4

Recent Ethereum price action saw ETH reaching another low of $2,150 on September 6, raising concerns of a more severe…

Solana (SOL) Could Crash 40% If It Stays Below $140 – Top Analyst Shares Insights

Solana (SOL) faces significant risk as the broader cryptocurrency market rebounds from local lows, yet SOL struggles to break above…